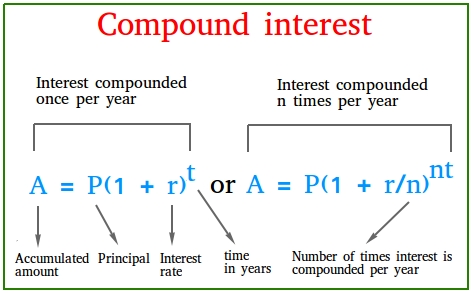

You also need to know how often the debt compounds.Convert it by dividing the interest rate by 100.

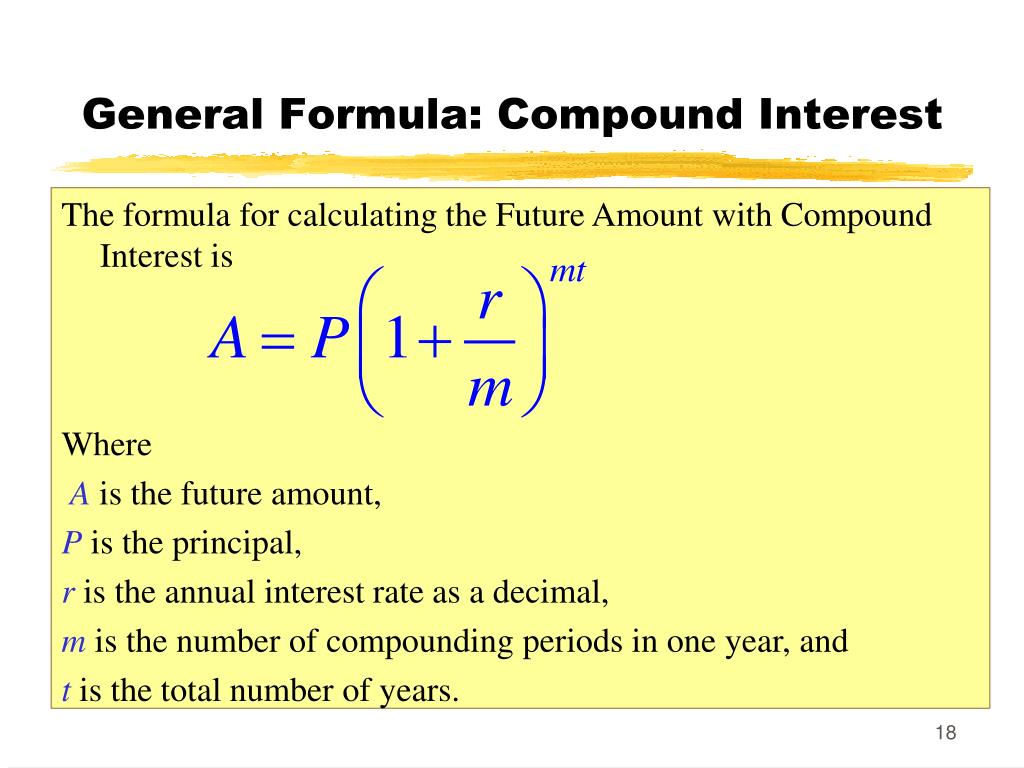

In the calculation, the interest rate will have to be input as decimal.For example, a 3.45% interest rate on the $5,000 principal value. The interest rate should be an annual amount, stated as a percentage of the principal. Locate the interest rate for the debt.For example, imagine your principal in an investment account is $5,000. This could be how much you deposited into the account or the original cost of the bond. This is the amount of your initial investment. Identify the principal of the investment.To use the formula, you need to gather the following information: X Research source You can use a compound interest formula for any calculation. If interest compounds more often than annually, it is difficult to calculate the formula manually. Gather variables the compound interest formula. You can also easily change values for principal and interest rate by altering the formulas used and cell contents. Continue this process to replicate the process for as many years as you want to track.Click on the lower right corner of cell C3 and drag the formula down to cell C7. This should give you the difference between the values in cell B3 and B2, which represents the interest earned. In cell C3, type "=B3-B$2" and press enter.

Click on the lower right corner of cell B3 and drag the formula down to cell B7. This means that your interest is being compounded annually at 6% (0.06).

This number is NOT the total number of days late Enter the principal amount:Įnter 0 through 31. If your payment is only 30 days late or less, please use the simple daily interest calculator. Invoice in which payment was made late, and the Prompt Payment interest rate, which is pre-populated in the box. To use this calculator you must enter the numbers of days late, the number of months late, the amount of the The following on-line calculator allows you to automatically determine the amount of monthly compounding interest owed on payments made after the payment due date.

0 kommentar(er)

0 kommentar(er)